Net Pay in Foreign Currency#

A PowerLink Solution:

Payroll calculations in Net Foreign Currency#

Net Pay in Foreign Currency#

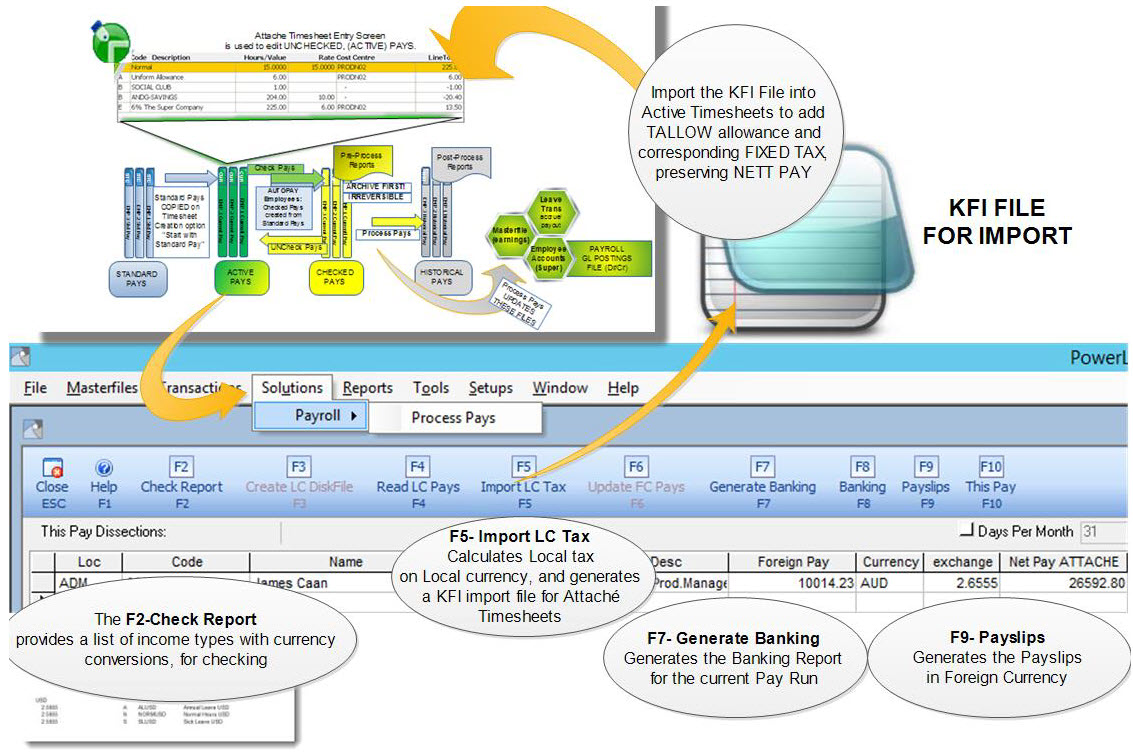

The Net Pay in Foreign Currency solution runs in PowerLink, with Attache Payroll, reading the Attache Timesheets, calculating Tax & GrossUp and updating the timesheets. This keeps all the reporting information in the Payroll itself, including the exchange rate used for calculations marked as a comment on the timesheet as a permanent record.NET Pay expat Contracts#

Net Pay in Foreign Currency is often challenging to manage.For example, paying an Australian Expat worker in Papua New Guinea with a contract negotiated in Net Australian Dollars…

Currency at current rate#

First, it is necessary to represent the AUD amount in PGK (PNG Kina).PNG Tax needs to be reported in PGK, so it makes sense to hold and calculate the payroll in PGK.

Grossup & Reporting#

Then, we can calculate the tax to be paid on the Net amount in PGK,

and apply the correct Tax, GrossUp and Exchange Rate comment to the

timesheet.

Finally, we can pay to multiple bank accounts in different currencies and email/print/PDF Payslips in dual currency.

Net Pay Solution written by Geoff Tollefson (2005-2020) and Paul Kelly (2015-2020)

);

background-size: contain;

background-repeat: no-repeat;

background-position: center;

height: 78px;

width: 134px;

);

background-size: contain;

background-repeat: no-repeat;

background-position: center;

height: 78px;

width: 134px;

);

background-size: contain;

background-repeat: no-repeat;

background-position: bottom;padding-bottom: 250px;}

.page {padding-bottom: 0px; }

);

background-size: contain;

background-repeat: no-repeat;

background-position: bottom;padding-bottom: 250px;}

.page {padding-bottom: 0px; }